Press Statement From Calvert Investments, Originally Released 5th May, 2014.

Unresolved Legacy of Bhopal Disaster Deserves Scrutiny of Dow Chemical Investors

Nearly thirty years after the tragedy, victims continue to suffer and Dow’s business prospects in India appear to be damaged.

5/14/2014

May 14, 2014///Bethesda, MD///As Dow Chemical convenes its Annual General Meeting on May 15th ahead of the 30th anniversary of the Bhopal disaster of December 3, 1984, Calvert Investments remains deeply concerned over the continuing suffering of the victims of that tragedy as well as the damage to Dow’s business opportunities in India incurred by acquiring Union Carbide in 2001.

“We believe that Dow shareholders have the need—and the right—to understand the past legacy and the future impact that the company continues to carry from Bhopal,” said Bennett Freeman, SVP for Sustainability Research and Policy at Calvert Investments.

Calvert urges Dow to act on the recommendations made in its recent shareholder resolution proposing that the company undertake and disclose an assessment of short and long term financial, reputational and operational impacts that the legacy of the Bhopal disaster may, if left unresolved, have on Dow’s Indian and global business prospects. Only then can Dow’s shareholders and stakeholders assess the extent of lost revenue and business opportunity for the company against the backdrop of the tragedy still endured by the victims of the Bhopal tragedy.

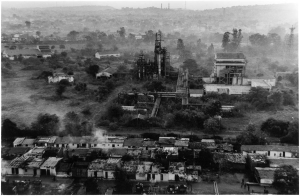

The Bhopal disaster involved the release of a deadly gas, methyl isocyanate, at the Union Carbide subsidiary pesticide plant in Bhopal, Madhya Pradesh, India. It is estimated that nearly 7,000 people were killed within the first three days and that ultimately, at least 23,000 people have died as a result of the fallout in subsequent years.

Although a settlement with Union Carbide was reached in 1989 and Dow itself has not been found legally liable, Dow continues to face public and political controversy in India due to allegations of incomplete environmental remediation and inadequate compensation of victims. While Dow insists that that there has been no financial, reputational or operational impact on the company from Bhopal, at least three separate business opportunities in India have been undermined in recent years: with Indian Oil (cancelled 2005); Pune R&D Center (cancelled 2010); and Gujarat Alkalies and Chemicals (joint project cancelled 2012). These cancellations have resulted in significant revenue loss for Dow in India.

Calvert believes that there is a direct connection between the unfinished business of the Bhopal disaster and the fact that Dow has generated only modest growth in one of the most dynamic economies in the world. Indeed, according to McKinsey, India’s specialty chemical sector is set to become the 4th largest global market within this decade. Failing to resolve Dow’s remaining issues from the Bhopal disaster will continue to damage Dow’s growth prospects in India.

It is also clear that the company’s reputation and brand have been tarnished by its association with the Bhopal legacy. For example, the company’s sponsorship of the 2012 London Olympics triggered public protests and negative press coverage. Following the event, independent corporate governance research agencies pointed out that the attention received was damaging for Dow. Even London’s City Hall stated that Dow’s sponsorship had “caused damage to the reputation of the London Olympic and Paralympic Games” and sought to reassess the criteria for company sponsorship in future events as a result.

As a Dow shareholder through our Calvert SAGE™mutual funds emphasizing intensive engagement in corporate responsibility and sustainability issues, Calvert believes that that Dow shares a moral responsibility with the government of India and other stakeholders to address the need for further environmental remediation and victim compensation.

About Calvert Investments

Calvert Investments is a leading investment management company using sustainability as a platform to create value for investors. Serving financial advisors and their clients, retirement plans and insurance carriers, and institutional investors, the company offers a broad array of equity, bond, and asset allocation strategies, featuring integrated environmental, social, and governance (ESG) research and corporate engagement. Strategies are available through mutual funds, sub-advisory services, and separate account management. Founded in 1976 and headquartered in Bethesda, Maryland, Calvert Investments had more than $ 13 billion in assets under management as of 4/3013. www.Calvert.com