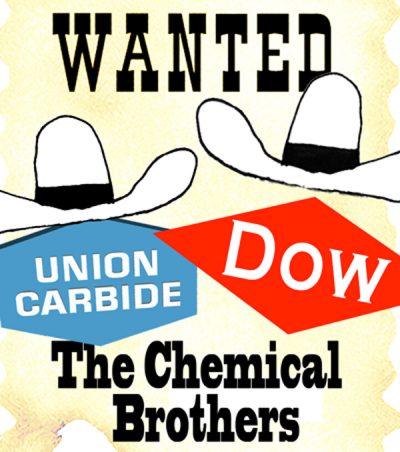

Corporate Veil Between Dow Chemical and Union Carbide

Now you see Carbide, now you don’t

“From day one we started to plan for the close of Carbide” said Dow Chemical CEO Michael Parker in June 2001, after Dow and Union Carbide merged in a deal in which all Carbide’s shares “shall no longer be outstanding, shall be cancelled and retired and shall cease to exist”. The new arrangement was summarised by Dow’s Head of Communications in an internal message to employees of the former Union Carbide and the new Dow:

“All business activities are done under the umbrella of a Dow business. We face the market as Dow. Reporters will be tempted to keep talking about Union Carbide. But we should discourage reporters from using the words Union Carbide, unless it’s reference to a historical activity. There should be no need for a trade press reporter to refer to Union Carbide, as we face the market as Dow. They should not call a product a ‘Union Carbide product’. All products are sold as Dow products now. Any current or future activity of a business is done as Dow.”

A decade later, however, Dow’s entirely contradictory position is that “Dow and UCC are separate companies”.

Summoned to answer a gas disaster claims case in the Supreme Court of India, Dow complained that the suit had been brought against it due to “an erroneous assumption that UCC has merged into Dow.” Instead, Dow deposes Union Carbide to be an “independent corporate entity”, with Dow itself a mere “shareholder”.

As reports are filed in its name with financial regulators in the US, Union Carbide does still appear to exist as a legal entity. But while US financial accounting standards require that the various ‘operating segments’ of a corporation report results separately, Union Carbide’s regulatory filings declare that it is unable to comply since “Union Carbide Corporation’s business activities comprise components of Dow’s global operations rather than stand-alone operations . . . there are no separable reportable business segments for Union Carbide.”

So if Union Carbide is not functionally separate from Dow, what kind of entity is it? The 2001 deal with UCC was termed a ‘merger’ within Dow’s own public statements. Due to the merger, shareholders in Dow became shareholders in UCC; UCC shareholders became Dow shareholders. All assets and liabilities of both companies were combined using ‘pooling of interests’ into one consolidated account. Union Carbide’s pre-existing debts and obligations became registered as charges upon the corporation’s consolidated accounts; this fact was borne out on January 9th, 2002, when the settling of an asbestos suit filed against Union Carbide in Texas, knocked over $7 billion from Dow’s own share price.

Union Carbide declares itself to be principally a Texan business to India’s courts. But the New York Registrar of Corporations, where the company has been listed for almost a hundred years, reveals its head office to be Midland, Michigan, where Dow also happens to have its head office.

Tax filings in Texas detail the company’s officers and board directors. Almost every single Union Carbide board director listed since the merger is either based 1,137 miles away in Midland, Michigan or is an acting Dow manager, or both. Every year since the merger, Union Carbide’s CEO and Chairman has been, without exception, simultaneously a Dow manager.

When Courts are asked to ‘lift the corporate veil’ between companies they apply a number of tests to discern the substantive reality behind the corporate form. One of those tests seeks to establish who benefited from the change in form. Since Dow announced the merger with Union Carbide, sales have risen 150% to stand at $57 billion annually. Union Carbide’s annual sales began at $6.5 billion in 2001, and are declared to be $6.9 billion in 2014. Of these sales, 98% are now direct to Dow itself.

Of the various means for piercing the corporate veil between different segments of a corporation the most powerful is the charge of fraud and abuse of the corporate form. Court submissions discovered by Bhopal campaigners reveal that throughout the 1990’s, and unable itself to sell directly due to the unresolved criminal matter, Union Carbide employed a third party to distribute its products within India and thereby avoid a property attachment order intended to force its attendance at trial.

Following the merger, the pre-existing contractual relationship with the third party presented Dow’s Indian holdings with a business dilemma. Dow considered distributing Union Carbide produced goods in India directly, thereby using Dow’s own ‘separate’ corporate identity to enable Union Carbide to evade criminal trial. In April 2001, an employee of Dow Chemical Pacific outlined the proposed solution: “[p]resuming the product ships directly from USA to India, my suggestion is to selling the product under Dow legal entity with Dow label and document will be a good way to proceed.”

A year after the merger, Dow cancelled the contract with the third party and took over all trade in Union Carbide products in India. Dow informs Indian courts that these are bought in “fair value transactions” outside of India and are therefore not Union Carbide property when in the country.

Dealing with Double Jeopardy

The Dow Chemical Company knew exactly what it was getting when it swallowed Union Carbide Corporation. Following completion of the $8.1 billion merger – a process which took 18 months – Dow officials claimed to have conducted an “exhaustive assessment”. But even a five minute browse of the internet would have discovered the unaddressed mass homicide charges.

The following spring, a court action by Dow shareholder Martin Statfeld observed that the two companies were withholding information concerning Carbide’s criminal and environmental liabilities from regulatory authorities in the U.S. and worried that they would eventually become Dow’s. Every member of Dow’s board was named in the action, which was successfully thwarted – on a technicality – by Dow’s lawyers.

The company’s AGM took place a few days after this suit was filed, in May 2000. Responding to shareholder questions, Dow’s Chairman Frank Popoff acknowledged that “the [Union Carbide] case has been reopened to some degree” in India and admitted that Dow was worried about double jeopardy. “That’s a tough question, one that we’ll have to deal with.”

Dance of the Corporate Veils

Union Carbide was a fugitive when Dow merged with it and is a fugitive now. If Dow is not Carbide, then Dow is harbouring a fugitive, a distinct offence under Indian law. If Dow is Carbide, Dow is also a fugitive.

When the criminal court attempted to resolve this issue in 2004, Dow India informed the court that it had “no nexus” with either Dow Michigan or Union Carbide. In 2005 the court issued a summons to Dow Michigan. But, shortly after, Dow India applied for a freeze on the summons, arguing that Dow Michigan had “no nexus” with Union Carbide.

The court granted the freeze, which was finally overturned in October 2012. Dow Michigan has now been ordered to attend court, on several occasions, and explain the whereabouts of its absent subsidiary but has, thus far, refused to do so. The latest notice was issued in September 2015 requiring attendance on 19th December 2015.

Not content with obstructing legal process by its use of multiple corporate forms, Dow managers sought to force Indian Ministers, including the Prime Minister, to intervene in legal proceedings and end legal pursuit of Bhopal liabilities against “non-Indian companies”. Bilateral US-India trade organisations and US officials were employed to lever additional pressure, and a one billion dollar investment programme was made conditional upon Indian complicity in getting Dow off the hook. The scheme failed after right-to-information work by Bhopal survivor groups exposed the whole farrago.

14 years after UCC merged into Dow, the strategy adopted to deal with the question of jeopardy remains the same. It arguably involves harbouring a fugitive; obstructing justice; becoming an accessory after the fact; subverting legal orders; backroom dealing; drawing the corporate veil; and deliberately misleading investors, regulators and the international public.

No Justice, No Business

Union Carbide declares itself to be part of Dow’s global business. Dow’s global business, therefore, is contesting ‘polluter pays’ legislation whilst thousands of innocent families continue to be poisoned. Dow’s global business is a fugitive from India, on the run from criminal charges.

Despite three decades worth of legal travesties, dirty politics and gross miscarriages of justice, Bhopal Disaster survivors have maintained an unbending determination to obtain remedies and restitution via legal processes and, purely as a result of their interventions, criminal, civil and environmental cases remain alive in Indian and U.S. jurisdictions.

In response, Dow’s Indian subsidiary has itself filed several legal suits against Bhopal survivor groups – which include some of the poorest people in the world – the latest of which includes a demand for hundreds of thousands of dollars.

See Also: Anger in India as leaked documents reveal that fugitive Union Carbide continues to trade CLICK

Refs:

[i] Committee on Government Assurances report, op cit. ch.2 para. 7